2016 Presidential Election

It’s been a long, long campaign. Odd that neither party has a candidate who lifts the spirit of voters – with the exception of the hard core base for each candidate. For them, what their candidate says can do no wrong. It is a campaign without policy – especially economic policy. One candidate is full of character assassination; the other is full of detailed objectives not bound by policy. In each case, we’ll have to discover policy after one is elected President.

The press, too, has done a poor job. We should be used to it; they have done a bad job since Murrow, Huntley and Brinkley were news anchors. Unfortunately, the on-the-ground news journalists really would like to do a better job but they are constrained by bosses who want only news that brings viewer share. Not only should big money be removed from the politicians, it should be removed from news rooms as well.

Many voters the mariner has spoken with have placed their hopes on the Congressional races. It will take nothing short of collusion between voters to replace a decadent and bought Congress with a modern, statesmanlike one.

Lack of economic plans for the next ten years and beyond.

Neither Donald nor Hillary has had a sit-down with the American voter to discuss the realities of US economics. To quote economist Robert Gordon[1]:

“Even if innovation were to continue into the future at the rate of the two decades before 2007, the U.S. faces six headwinds that are in the process of dragging long-term growth to half or less of the 1.9 percent annual rate experienced between 1860 and 2007. These include demography, education, inequality, globalization, energy/environment, and the overhang of consumer and government debt. A provocative “exercise in subtraction” suggests that future growth in consumption per capita for the bottom 99 percent of the income distribution could fall below 0.5 percent per year for an extended period of decades.”

In a past post, the mariner took a thread of thought from Gordon’s paper published in August 2012, Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds. Gordon’s logic is a central pillar in the mariner’s economic perspectives. The topic in the post was whether rapid product versions were actually growth. In a recent interview on PBS’ News Hour, Robert touched on this thread, covering his entire presumption about future growth – the six headwinds.

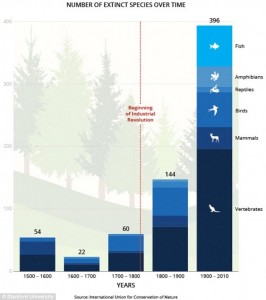

Given the nation’s current state of affairs – especially an election offering a rich narcissist or a richer establishmentarian, Gordon’s concern about restoring an historically robust economy is real. To paraphrase Gordon, We invented cars – no more horse manure to clean in the streets; we invented electricity – no more drudgery for housewives and services; we invented air conditioning and heat – no more coal to shovel or sweaty homes; we invented airplanes – transforming travel; we invented Interstates – now everyone can travel coast to coast; we invented radio and computers and speed of light communication. What is the next “new” phenomenon that will change the world and provide huge numbers of jobs for generations?

This requirement for a new direction in the daily life of 300 million Americans is a stiff requirement. Already, the US has reported that ‘there are no more jobs.’ Unions are driven out of existence, salaries continue to drop precariously as a percentage of GDP, and oligarchy is entrenched in the American culture. Rebuilding the nation’s infrastructure, from potholes to fiber optics, will not be a permanent reprieve.

Gregory Clark[2], an economist as well, challenges Gordon’s view by suggesting a computerized future is the new economic force. The mariner agrees with Gordon: Already we have invented computers; Gordon sees computers as a dividing force in economics – making the rich richer and the other 99% poorer.

Well, Donald and Hillary, what say ye?

[1] Robert Gordon is a renowned economist who has published many books and papers challenging many economic assumptions. Liberal in thought but conservative in assumptions, he is a leader in predicting future economic conditions.

[2] Gregory Clark, a professor of economics and department chair until 2013 at the University of California, Davis is most well known for his theory of economic history related to the change in behaviors that enabled the Industrial Revolution, discussed in his book, A Farewell to Alms: A Brief Economic History of the World.

A Farewell to Alms discusses the divide between rich and poor nations that came about as a result of the Industrial Revolution in terms of the evolution of particular behaviors originating in Britain. Prior to 1790, Clark asserts, man faced a Malthusian trap: new technology enabled greater productivity and more food, but was quickly gobbled up by higher populations. In Britain, however, as disease continually killed off poorer members of society, their positions in society were taken over by the sons of the wealthy, who were less violent, more literate, and more productive. This process of “downward social mobility” eventually enabled Britain to attain a rate of productivity that allowed it to break out of the Malthusian trap.

Ancient Mariner